October 15 2025

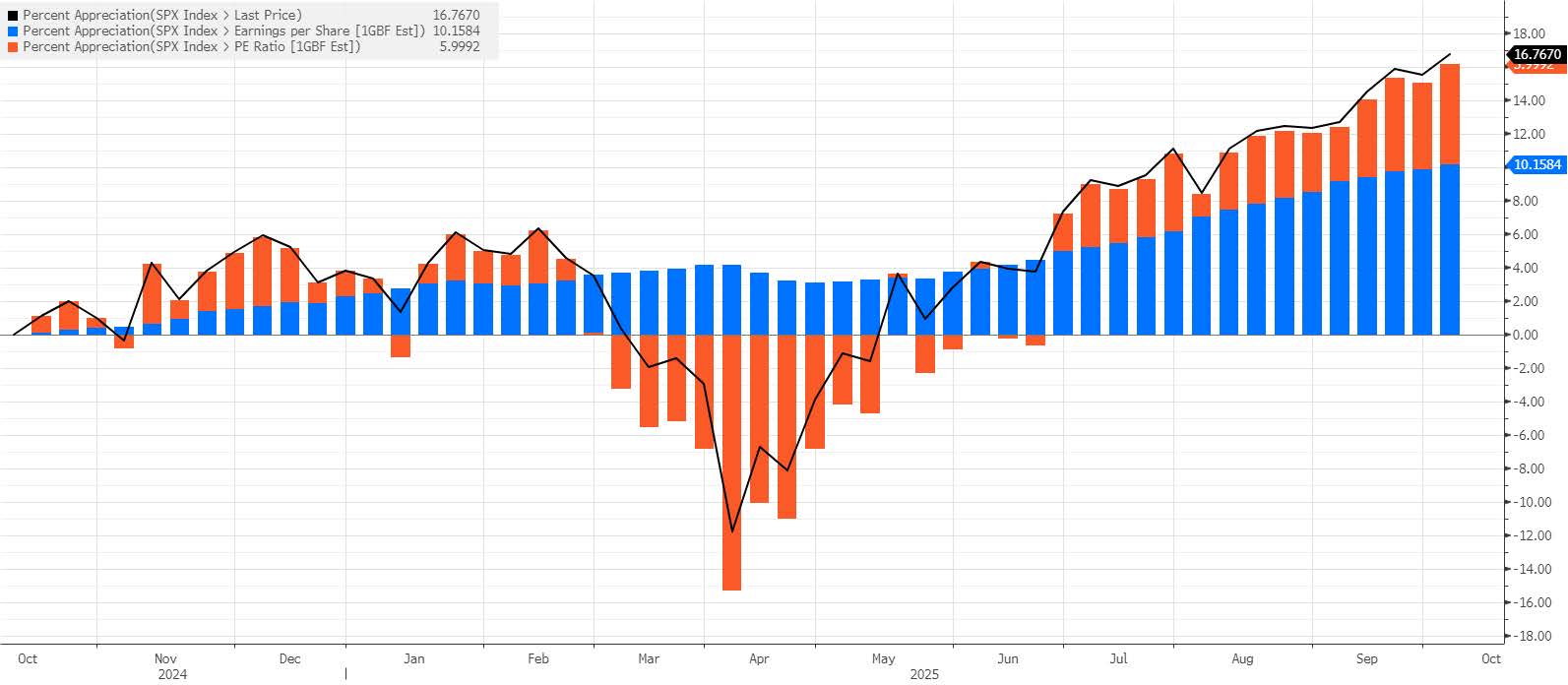

Stock Prices Tend to Move in Line with Earnings

Dear Friend:

The U.S. equity market performed well from its low in April, raising questions about whether we are approaching exuberant levels. There are fundamental reasons supporting the market’s strength, particularly strong corporate results. Revenue for all companies in the S&P 500 Index grew +5% year-over-year (yoy) in the first quarter of 2025 and +4% yoy in the second quarter. Earnings rose even more, +10% yoy in each of the first two quarters, and are expected to increase at a similar rate for the remainder of the year.

The return decomposition below illustrates that, of the 17% S&P 500 return over the past 12 months, 10% resulted from earnings growth (blue bars) and 6% from valuation expansion (orange bars), with the rounding error of around 1% coming from dividends. This indicates real substance behind the market rally.

Source: Bloomberg

For a fair assessment, it is important to note that companies benefiting from Artificial Intelligence (AI) and the associated digital infrastructure investments are major drivers of these results. J.P. Morgan research estimates that AI-related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital and research spending growth since ChatGPT launched in November 2022. However, this year we can observe a broadening of earnings growth beyond just a few companies. For example, S&P 500 earnings excluding the seven largest stocks, the so-called Magnificent 7, grew +9% yoy and +8% yoy in the first two quarters.

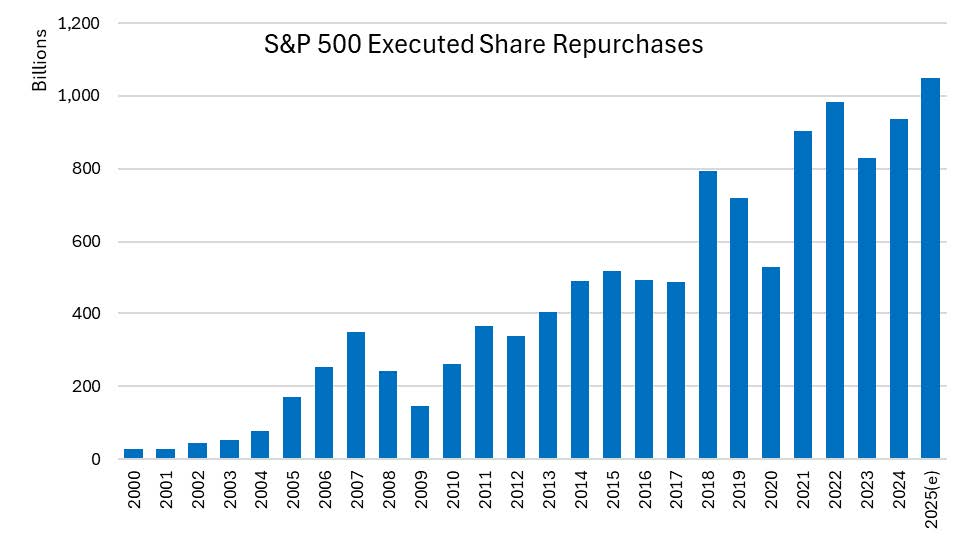

Another indicator of corporate strength is record stock buybacks, supported by robust earnings and strong cash flow generation. S&P 500 companies have announced share repurchases at an unprecedented rate, with close to $960 billion committed year to date, surpassing each of the previous ten years. Actual buyback executions have kept pace with this record level of announcements. If this year’s trend continues, total buybacks could exceed one trillion dollars by year-end (see chart below). The main contributors at a sector level are Technology and Financials, followed by Industrials.

Source: Bloomberg, J.P. Morgan; 2025 number is extrapolated based on 1H trend

We see a similar trend of strong fundamental growth across the individual companies we invest in, many of which also benefit from AI and related infrastructure investments. While a stock price correction is always a possibility on any given day for any reason, we generally regard it as an opportunity to further build or optimize your portfolios.

30 Years in Context

Shifting the focus from this year’s market development to a longer-term perspective, you might recall from our previous newsletter that Noesis is turning 30 years this fall. Much has happened in geopolitics, the economy, and financial markets during these past three decades, as the included 2025 Morningstar® Andex® Chart impressively shows (the last 30 years are highlighted in green). The U.S. economy went through three recessions (2001, 2007-2009, 2020), and the unemployment rate ranged from a low of 3.8% to a high of 10.0%. Inflation varied from periods of deflation to levels above 9% post-pandemic, while the 10-year interest rate declined from above 7% to below 1%. Oil prices fluctuated from $9 to $145 per barrel. The U.S. had five different presidents and various power constellations in Congress.

The financial markets faced three major bear markets, namely the Tech Bubble in 2000, the Global Financial Crisis in 2007, and the Covid-19 pandemic in 2020. In addition, markets have endured the

Asian currency crisis, September 11 attacks, Iraq war, bankruptcies of Enron and WorldCom, hurricanes Katrina and Wilma, Brexit, U.S.-China trade conflict, Russia’s invasion of Ukraine, the U.S. regional banking crisis, and the war in Gaza.

Conclusion

Despite these conflicts, crises, and economic cycles, the stock market has continued to grow, rising 9% to 11% annually over the past 30 years. Most of this return came from earnings growth, averaging 6% to 7% per year, while dividends contributed an additional 2%. In the long run, stock prices tend to move in line with earnings. These results emphasize the importance of investing in solid companies with competitive advantages, smart management, and healthy balance sheets, which then generate strong earnings and cash flows.

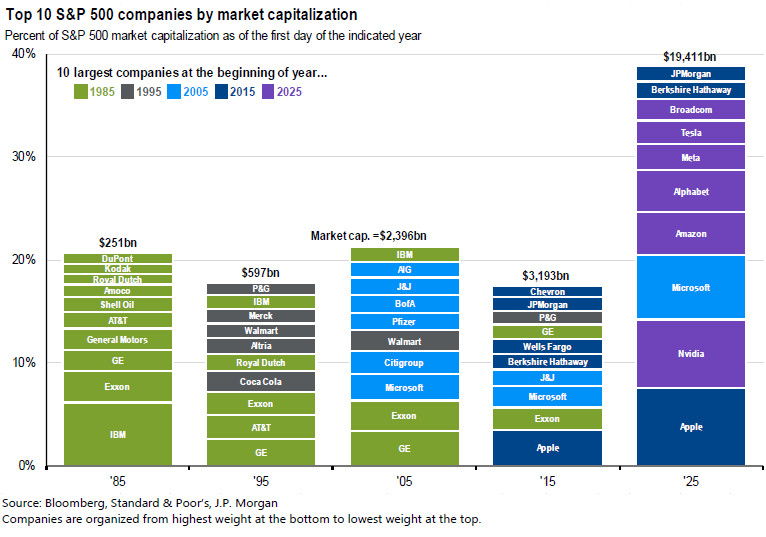

However, high-quality companies do not necessarily remain market leaders forever. New competitors and technologies can emerge; management can become complacent or transition without proper succession; and balance sheets may weaken after failed acquisitions. The chart below shows the ten largest companies by market capitalization at the beginning of 1985 and each consecutive decade through 2025. The composition changes constantly as market leaders disappear or are surpassed by new companies.

As investors, we must continually evaluate our holdings, judge the severity of new threats, identify more promising opportunities, and remain mindful not to overpay. Portfolios will benefit from applying discipline to the investment process and ignoring market noise and excitement.

Celebrating 30 Years of Noesis

As the Morningstar® Andex® Chart reminds us, markets move in cycles, but steady principles endure. For Noesis, the values of discipline, long-term perspective, and a client-first approach have shaped our work through three decades of change. This fall, we are proud to mark 30 years of managing client portfolios and guiding families through financial complexity with confidence.

On November 13, we will host our 30th Anniversary Celebration at the Broken Sound Clubhouse in Boca Raton, Florida. We are delighted to commemorate this milestone with our colleagues from Florida, Paraguay, the Netherlands, and Spain, along with the clients, friends, and partners flying in from all over the world who have made our journey possible.

Invitations have been sent, and we are thrilled by the many confirmations already received. If you have not yet RSVP’d, we hope you will join us for this special occasion. We remain grateful for the trust and relationships that have defined our journey and are committed to many more years of shared success and friendship.

Sincerely,

Christian Paterok, CFA