April 15, 2024

Fundamental Research with Contrarian Strategy

Dear Friend:

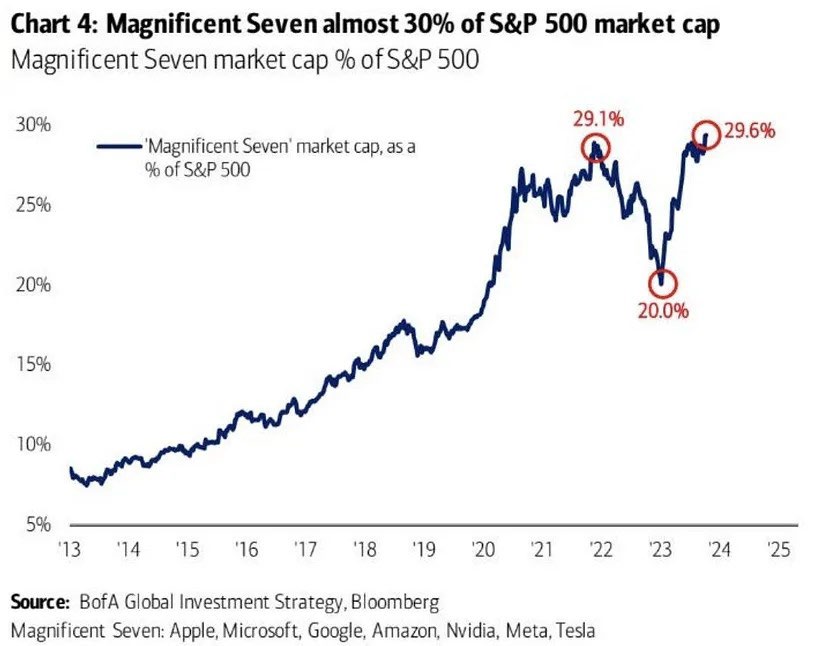

Last year, the S&P 500 index was led by the outperformance of the Magnificent Seven (Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla). The concentration of the Magnificent Seven was one of the highest in history, with these stocks making up about 30% of the S&P 500 (see chart below).

The question being asked now is whether the other 493 stocks will outperform and when, as the equal-weighted S&P 500 index (all companies in the index having equal weight) returned 12% last year, half of the S&P 500’s return.

2023 was a year marked by some of the highest interest rate increases in history, which contributed to investors piling up in large-cap stocks that are believed to be safe havens amid high inflation, rising borrowing costs, and anticipated fear of a recession. As the Federal Reserve (Fed) is expected to start cutting rates this year and a recession has been avoided, we believe that the rest of the stocks in the S&P 500 should start to catch up. Industries that are not represented by these mega-cap stocks have turned around. All S&P 500 sectors, except for real estate, recorded gains for the first quarter of 2024. Industrial and Financial sectors, which are usually tied to the economic growth outlook, have increased by 11.0% and 12.4% respectively, outperforming the rest of the market.

We have seen a pullback of some of the Magnificent Seven stocks: Apple and Tesla are down 11% and 29% respectively for the first quarter of this year. Apple faces weak demand in China, the company is receiving scrutiny from antitrust regulators, and there are concerns that it is falling behind in the Artificial Intelligence (AI) frenzy. Tesla is facing pressure from Chinese competitors and there is a slowing demand for electric vehicles (EV).

There are other companies with good growth prospects that are not getting the deserved attention from investors. We believe that staying disciplined, having a diversified portfolio, and maintaining strategic asset allocations are the best approaches to meet your financial objectives and to mediate the risk of market concentration when prices eventually reverse.

Company Stories

In 2016, we wrote about Google to demonstrate our efforts to combine fundamental research and contrarian investment strategies. We also explained why short-term trading is not a best practice when a company’s fundamentals are solid (www.noesis-capital.com/3rd-quarter-2016). Recently, we have encountered numerous tests of our philosophy and disciplines, but the lessons we have learned remain the same. Below we discuss how we applied the same practices to two of our core holdings: Taiwan Semiconductor Manufacturing and Stryker.

Taiwan Semiconductor Manufacturing (TSM)

Be greedy when everyone is in fear – TSM, the world’s largest chipmaker, was added to our core holdings right after the pandemic started in Asia. Based on the SARS experience in 2002, we believed the Taiwanese government could control the pandemic. Due to TSM’s importance in the semiconductor supply and the potential work-from-home demand, we saw an opportunity to own this reputable company when everyone was dumping Asia stocks in droves.

Supply chain constraints and the cyclicality of the semiconductor industry – During the first two years of the pandemic, the world was short of every electronic part and device. Since the supply chain is long, from the wafers to the final products, there was a surge in demand much higher than the typical cyclicality. However, we were fully aware that the supply chain issue was a short-term challenge and that the demand for chips would eventually slow down. So, instead of jumping on the runaway train of semiconductor trades, we stayed with names that would continue to do well even when the down cycle arrived in 2022.

Headline risk and reality check – The Economist called Taiwan “The Most Dangerous Place on Earth” on the cover of its May 2021 issue. However, according to our analysis, the elevated geopolitical risk between the U.S. and China was primarily reflected in economic activities, e.g., trades, tariffs, and IT product restrictions. The chance of developing into a military conflict was small. Because Taiwan is in a strategic geographic location and the island’s IT industry has been the backbone of the global IT supply chain for decades, it is no wonder both the U.S. and China have used Taiwan as a platform to display their geopolitical and economic power. News outlets grabbed this opportunity to create alarming titles to attract viewership, but the reality was

different from the headline stories. Taiwan’s GDP grew by 3.2%, housing prices rose by 6.3%, and the stock market rose by 9.9% annually between 2016 and 2023. These excellent economic statistics did not reflect an image of the most dangerous place on earth. One investment guru even joked that he usually used the Economist’s cover pages as contrarian indicators.

Artificial Intelligence (AI) boom and the sustainable business moat – We were puzzled by the lack of excitement about TSM in 2022 when the AI boom started. No matter who designs the most advanced chips, TSM would likely be the manufacturer. One recent development proved our point that TSM’s business moat is wider than those of the fabless (design but not produce) semiconductor companies. To challenge Nvidia’s dominance in AI chips, Alphabet (Google), Qualcomm, and Intel teamed up to develop software and tools that can power AI chips, regardless of who builds them. They also plan to bring Microsoft, Amazon, and Meta to this alliance. It looks like Nvidia’s moat will soon be challenged. However, no matter how the AI chip war evolves between the incumbents and the challengers, they are all TSM’s clients. TSM’s revenue growth is already higher than analysts predicted, increasing 34.3% year-on-year in March, which is the fastest pace since November 2022 due to the rise in interest in AI software.

Stryker (SYK)

Stryker is a leading medical device maker with a focus on Orthopedic implants and medical equipment for hospitals and other healthcare facilities. Among its broad product offerings is the very successful Mako Robotics, a robotic-arm-assisted surgical platform for knee, hip, and soon spine and shoulder procedures. Stryker became one of our long-term core holdings as we started to buy its shares in 2006 and have been adding to it during periods of price volatility.

Short-term issues or structural problems – Stryker historically delivered consistent, industry-leading revenue and earnings growth, however at the beginning of 2022 management gave a cautious outlook. Elective procedures for Orthopedic implants such as hip, knee, and spine remained delayed as an after-effect of the pandemic. The shortage of hospital staff added to the delay in procedures and thus revenue recovery. On the cost side, the company was plagued by supply-chain constraints for electronic components and inflationary pressure on input costs. Although disappointing to the impatient investor, these were shorter-term issues related to the pandemic.

Throughout 2022 procedures slowly recovered with reduced Covid severity and improved staffing levels. Management expected a growing patient backlog which had been building over the previous two years. However, the supply chain and inflation pressures persisted and led to several disappointing earnings results, which was unusual for Stryker. At one point management had to acknowledge that it misestimated the supply chain issue but reminded us that it was a one-time situation and that the company would return to growing margins and earnings in 2023. We could gain confidence from the fact that some competitors had similar issues, but the anxious investor hit the sale button again.

Eventually, the patient investor was rewarded in 2023. Orthopedic procedure volumes recovered to pre-pandemic levels in most countries and there remains high visibility for several quarters of backlog. The supply constraints were resolved, input cost inflation moderated, and the medical equipment segment benefited from its large backlog of orders. As expected, the company did not lose sales, as its customers waited for delivery instead of canceling orders, an indication of the competitiveness of Stryker’s products. Management’s realistic assessment of the situation and clear communication with shareholders helped us to exercise patience.

Headline noise – During 2023, weight-loss drugs from makers Novo Nordisk and Eli Lilly gained prominence in the media. After one of Stryker’s competitors mentioned a temporary decline of bariatric surgery procedures resulting from the use of these drugs, it sent a scare to the medical device industry and share prices started to drop. In the case of Stryker, there was concern about a slowdown of its knee implant business, while in reality, the segment reported continued sales growth throughout the year. Stryker’s management cautioned against an oversimplification of the relation between body weight and knee replacement as factors such as genetics also matter. In addition, the rate and persistence of weight-loss drug adoption is unknown. A recent trial showed that patients typically took these drugs for less than one year due to side effects such as nausea and low affordability, as they cost $900 to $1,100 per month and are not covered by health insurance. Should the drug adoption rise nonetheless, it might have positive effects for Stryker. A reduced body mass index allows knee surgery for patients who did not previously qualify and might lead to higher activity levels. Thus, the outcome for Stryker might be a larger pool of potential patients.

Conclusion

Simply said, Noesis’ recommendation is to pay attention to the companies’ fundamentals. As mentioned in our last newsletter, stock prices will eventually increase when companies grow their revenues, earnings, and cash flows. Therefore, remember the importance of sticking with quality companies even when they are out of favor for a period of time. We believe it is essential to remain disciplined and to focus on a long-term approach to better meet your financial goals.

Sincerely yours,

Shihfang Chuang

Christian Paterok, CFA

Laleeta Hill, CFA