Focus on What to Own

Dear Friend:

Our colleague Michiel Scholten, who runs our Dutch office in Amsterdam, will discuss Russia’s invasion of Ukraine in the first part of this quarterly letter. Being geographically closer to the conflict makes him well-suited to write about this war and its consequences. The second part of our newsletter will focus on the meme stock mania that emerged last year.

War in Europe

On February 24, Russia’s President Putin announced the start of a special military operation to disband Ukraine. In that speech, he said that all Ukrainian soldiers/troops who surrendered would be allowed to rejoin their families in peace. It is now almost two months since the invasion of Ukraine and Russia has still not achieved any of its initial goals. Ukrainian soldiers did not surrender, and it is evident that President Putin and his advisors miscalculated the fierce resistance of the Ukrainian people. The impact of the humanitarian crisis in Ukraine is enormous: thousands have been killed, entire cities demolished, and more than four million citizens have fled the country.

The short-term reactions are in line with most dramatic events. The financial markets dropped 10%, partly because of the news that President Putin activated Russia’s nuclear forces right after the start of the war. As so often before, the markets recuperated from those losses and are now trading higher than before the invasion.

Whatever the outcome for Ukraine, it is clear that Putin will create a new Iron Curtain in which his country will be isolated from the Western world. A world, and especially Europe as a region, where large countries will strive to become more self-supporting and less dependent on others. In the near-term, it will strengthen Western cooperation with energy transition and the provision of essential commodities.

Whatever the outcome for Ukraine, it is clear that Putin will create a new Iron Curtain in which his country will be isolated from the Western world. A world, and especially Europe as a region, where large countries will strive to become more self-supporting and less dependent on others. In the near-term, it will strengthen Western cooperation with energy transition and the provision of essential commodities.

Earlier this year, the financial world focused on interest rate hikes due to high inflation. Then the war in Ukraine further increased global inflation. In Western Europe, the dependence on Russian gas became evident, and the diabolical question is whether to stop imports from Russia entirely. It will seriously hurt Europe, and in Germany, GDP may decline between 0.5% and 3%.

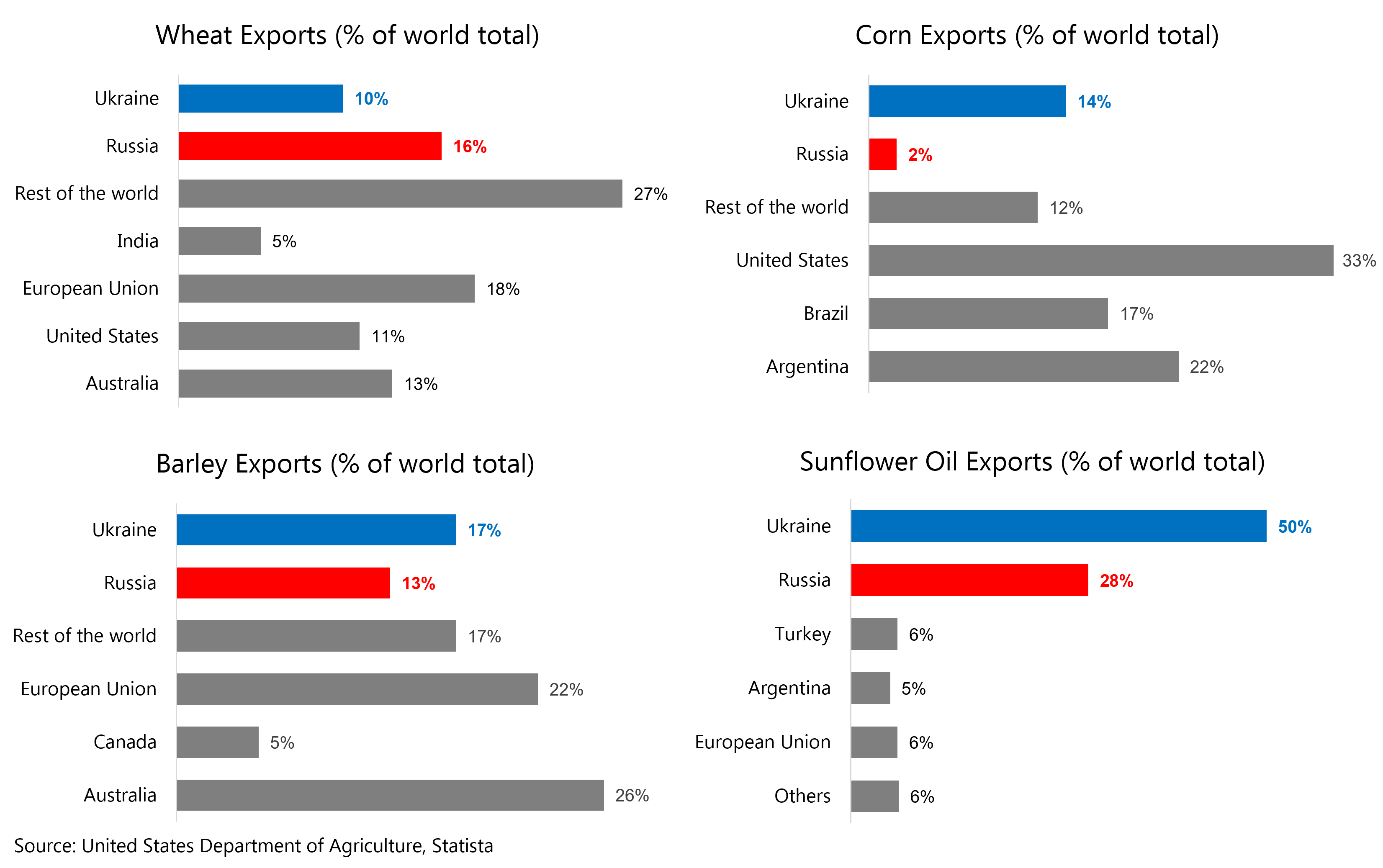

The world food situation will also be severely influenced. One in eight (1 in 8) calories traded on the world markets come from Russia or Ukraine. The crop planting season has yet to begin and supply is already at a low. The resilient Ukrainians will undoubtedly try to plant as much as they can. The big question is how much they can plant and whether they can harvest and transport their crops.

Top Wheat, Corn, Barley, and Sunflower Oil Exporters 2021/2022

A disrupted harvest season in Ukraine will significantly impact the agriculture supply in emerging markets, such as Africa and the Middle East. History has shown that hunger and revolutions go hand in hand. In these emerging regions, most of the household spending is on food. In combination with the extreme weather conditions of the past years, the war in Ukraine coincides with an unfortunate moment in time. A continued rise in food prices can prelude large-scale political instabilities worldwide.

The disaster in Ukraine has also had some unforeseen and unparalleled positive impacts on Europe. Due to the war, President Putin has unified NATO better than any Western leader before; the relationship between the European NATO countries and the U.S. has been restored. Ideological differences have been pushed aside for the time being, and conservatives and staunch socialists are united in their view that nuclear power plants and larger defense budgets are essential for years to come. Instead of dividing the European Union into friends and foes, Putin now faces a strengthened E.U. The Western and Eastern member states are more unified.

What about the long-term, big-picture consequences of this war? The trend toward deglobalization that started with the U.S. withdrawal from the Trans-Pacific Partnership and continued with the trade war between the U.S. and China keeps gaining momentum. All sorts of international alliances will be subject to an evaluation in this respect. New bonds, new (trade) agreements, and new brotherhoods will emerge. It will take leadership and vision to build these and look beyond the present chaos. We have not seen a bond between NATO partners as strong as they are today in decades. May many more of such liaisons be struck with a view of a better world. Unintentionally, President Putin has given the democratic world a wake-up call.

Meme Stock Hype

Over the past two years, we received many inquiries regarding popular stocks mentioned on news channels and investment forums, including MEME and SPAC stocks. Our investment discipline identified them as non-investable ideas, and in the meantime, they went through a boom-to-bust cycle. We may see these names or similar hypes appear again in the future, especially if investors ignore sound principles and allow the “fear of missing out” emotion to influence their behavior.

There have been many investment manias in the financial world history, and one of them is the meme stock mania that emerged last year. The word “meme” is from the ancient Greek word “mimema,” meaning imitation. A meme stock refers to shares of a company that gain a cult-like following through social media platforms and online forums like Reddit. The meme stock craze started in January 2021, when retail investors bid up prices of stocks like GameStop, AMC, Blackberry, and Bed Bath & Beyond. Meme stocks surge in price quickly due to a sudden increase of online or social media interest, resulting in subsequent buying among small individual investors. These short-term surges can reverse course quickly, making meme stocks far more volatile than average stock market moves.

The meme stock movement started during the pandemic when most people were stuck at home and were looking for ways to turn some extra free time into money. This movement was further enhanced by stimulus checks, sharing ideas on social media, buying on margin at very low interest rates, and the ease of stock trading on new digital apps like Robinhood.

In January 2021, approximately six million people downloaded trading apps in the United States, leading to record-high average daily volumes for equity and options trades within retail brokerages. Credit Suisse estimates that retail investors accounted for a third of all U.S. stock market trading at times last year. The chart above shows the increasing market share of retail trading to overall U.S. equity trading volumes. In the first quarter of 2020 and again in the first quarter of 2021, retail trading volume jumped drastically, coinciding with stimulus payments to U.S. households in March and December 2020, and again in March 2021. Since then, retail trading has been declining towards its long-term volume again.

Meme stock companies are usually struggling financially. GameStop is a brick-and-mortar video game retailer suffering from declining market share as millennials abandon physical stores to download or stream video games online. The company’s sales have fallen in 11 of the last 16 quarters, with the most pronounced declines occurring in 2020 when the Covid-19 pandemic closed its shops. GameStop has been producing losses since 2018 and has changed CEOs four times during that period. In January 2021, hedge funds shorted the company’s shares in the hopes of making money if the share price fell. However, the stock rose by more than 1800% within a few weeks, causing enormous losses to these hedge funds.

AMC has seen its movie theaters shutter during the pandemic, and it emerged as another meme stock investor favorite. For the company’s CEO, Adam Aron, that created an opportunity to raise capital and pay off the ailing company’s debts. However, the stock tumbled when investors became disillusioned when Aron started selling shares as part of a prearranged estate planning strategy, despite warnings that Aron and other executives had plans to reduce their AMC holdings.

A meme stock’s value is primarily driven by investors on online forums and not necessarily by the company’s economic performance. Though there is potential for significant gains, meme investors are more likely to experience losses as the stocks become overvalued and their prices fall dramatically. This year, the weak price performance of meme stocks can be attributed to investors derisking their portfolio due to fading stimulus money, rising inflation and increasing interest rates.

Focus on What to Own

What investment conclusions can we draw from the two discussed and unrelated events? The first is to control our fear in the case of the Russia-Ukraine war and to control our greed in the case of the meme stock hype. Second is adhering to a proven investment discipline that examines the quality of a business’ fundamentals, its management, and valuation. Such practice can go a long way towards balancing short-term gains from fleeting social media trends or hopes of a temporary short squeeze. Understanding the investment holdings can also give confidence that these companies will survive and thrive during challenging times. And third, not trying to time the market or geopolitical events – stay focused on what to own, not when to own.

Sincerely yours,

Research Team