How Noesis Looks at Sustainability

How Noesis Looks at Sustainability

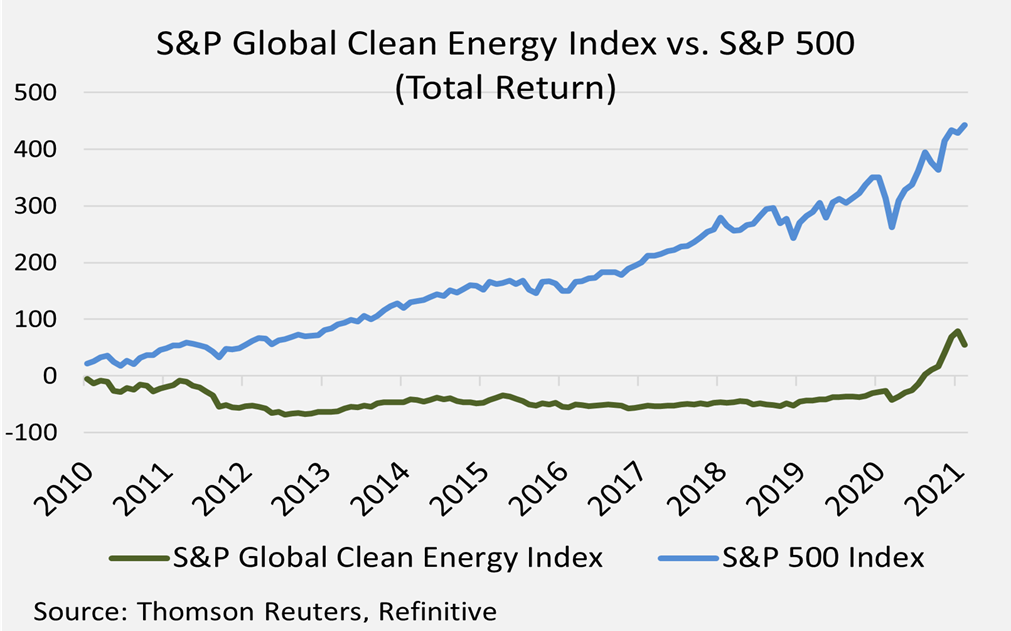

Over the past year, we have received  many inquiries about how to invest in sustainable companies. It was not until the ESG (Environment, Social, Governance) theme became a popular keyword in the media that investors started to correlate sustainability, social responsibility, and corporate governance to economic performance. For example, the S&P Global Clean Energy index has not performed for a long time until last year. We believe investors’ renewed interest in sustainable investing contributed to the recent upswing in performance.

many inquiries about how to invest in sustainable companies. It was not until the ESG (Environment, Social, Governance) theme became a popular keyword in the media that investors started to correlate sustainability, social responsibility, and corporate governance to economic performance. For example, the S&P Global Clean Energy index has not performed for a long time until last year. We believe investors’ renewed interest in sustainable investing contributed to the recent upswing in performance.

At Noesis, we invest for the long run,  and we believe only high-quality companies can withstand the challenges internally or externally over a long period. However, a company’s ESG performance cannot be determined simply by companies’ self-reported scores, nor can it be validated by subjective third-party rating metrics. We take a holistic view of companies’ efforts and compare them to their close peers.

and we believe only high-quality companies can withstand the challenges internally or externally over a long period. However, a company’s ESG performance cannot be determined simply by companies’ self-reported scores, nor can it be validated by subjective third-party rating metrics. We take a holistic view of companies’ efforts and compare them to their close peers.

First, on the “Environmental” pillar, we want to introduce a more comprehensive concept – “Circular Economy.” Using this intellection, we examine the whole process, not just the most talked-about input resources and final products. A circular economy employs re-use, sharing, and recycling to create a closed-loop system that minimizes resource inputs and waste, pollution, and carbon emissions. Such an approach aims to keep things in use for longer, thus improving the resources’ productivity. Furthermore, waste materials and energy will become  input for other processes. Therefore, resource-hungry businesses can neutralize their carbon footprint by creating a circular economy internally or externally. No wonder MSCI scores electric-car maker Tesla and oil major Royal Dutch Shell the same on ESG, just above the halfway mark. Popular opinion might think otherwise since Tesla makes clean cars and Shell produces oil. But Tesla’s cars are big and heavy and often powered by electricity produced by burning coal. At the same time, Shell has laid out a plan to reach net-zero carbon by 2050 and scores higher on social and governance than the electric vehicle (EV) manufacturer.

input for other processes. Therefore, resource-hungry businesses can neutralize their carbon footprint by creating a circular economy internally or externally. No wonder MSCI scores electric-car maker Tesla and oil major Royal Dutch Shell the same on ESG, just above the halfway mark. Popular opinion might think otherwise since Tesla makes clean cars and Shell produces oil. But Tesla’s cars are big and heavy and often powered by electricity produced by burning coal. At the same time, Shell has laid out a plan to reach net-zero carbon by 2050 and scores higher on social and governance than the electric vehicle (EV) manufacturer.

The second pillar is the social score,  which primarily evaluates the relationship with stakeholders, especially with its employees and suppliers. It could also include charity and community involvement as well as diversity in gender and race. For example, if a company provided its employees with necessary personal protective equipment during the pandemic, and whether it did enough to protect low-salaried staff’s income. The idea is that productivity is tied to the happiness and safety of labor and fairness to other stakeholders. Diversity improves a company’s ability to attract and retain talent, and more diverse inputs allow for different perspectives and lead to better decisions. In 2017, MSCI and Thomson Reuters’ research showed improved productivity growth when more women were added to the corporate boards, even for those companies without a sophisticated talent management program.

which primarily evaluates the relationship with stakeholders, especially with its employees and suppliers. It could also include charity and community involvement as well as diversity in gender and race. For example, if a company provided its employees with necessary personal protective equipment during the pandemic, and whether it did enough to protect low-salaried staff’s income. The idea is that productivity is tied to the happiness and safety of labor and fairness to other stakeholders. Diversity improves a company’s ability to attract and retain talent, and more diverse inputs allow for different perspectives and lead to better decisions. In 2017, MSCI and Thomson Reuters’ research showed improved productivity growth when more women were added to the corporate boards, even for those companies without a sophisticated talent management program.

Noesis is an excellent example of benefitting from diversity. Our employees come from four different continents, eight different countries and speak more than six languages fluently. Because of this diversity, we can serve clients in thirty-plus countries; and most importantly, such diversity allows us to conduct investment research with a more localized knowledge in the global markets. More than half of our staff are female, and they are responsible for all functions, including research, portfolio management, prospect and client meetings, and operations.

Before ESG became a trendy term, we already applied corporate governance, the third pillar of ESG, to filter investment ideas. Governance is also a constant item we monitor throughout the holding period and re-evaluate annually during proxy voting. A well-defined corporate governance system can align interests between stakeholders and work as a tool to support a company’s long-term strategy. When voting proxy at annual shareholder meetings, we check the board’s structure, the independence of the audit, compensation, and nomination committees, as well as the shareholder rights, including voting requirements for special meetings. Furthermore, we look into the individual board members’ other activities and analyze the executive compensation compared to its main industry peers. We also care about the use of political donations and lobbying work. Enron’s story in 2001 is the best example of how poor governance and inadequate internal control eventually led to business failure.

Barron’s magazine has been conducting a list of the top 100 U.S. sustainable companies since 2016, and these companies performed better than the broader market on average for the past few years. The list started with the 1,000 largest publicly traded companies by market value, ranked each by how they performed in five key constituencies: shareholders, employees, customers, community, and the planet. Specifically, more than 230 ESG performance indicators were evaluated, such as workplace diversity, data security, and greenhouse gas emissions. This year, two of the top three names on the list are core holdings for Noesis and our clients, Agilent and Ecolab. In total, there are six of our holdings on the list, and the others are Nike, Lowe’s, PepsiCo, and NextEra.

No. 2-ranked Agilent makes laboratory instruments and software. It has been on Barron’s list for the past three years. Surprisingly, the average laboratory consumes more energy per square foot than a typical hospital and an office building. The below graphic shows the estimated energy-saving by the U.S. Environmental Protection Agency if the laboratory power consumption is reduced by 30%. Agilent was able to help its customers lower their carbon footprint by supplying instruments that use less power, fewer chemical solvents, and minimal packaging. As a critical member in the supply chain for COVID tests and vaccine development, Agilent was determined to run at the maximum possible capacity to support the industry while taking care of employees’ benefits and safety during the pandemic. Not only did they guarantee jobs  and protect base pay, but they also used 3-D printers to make face shields for local healthcare providers and made masks and hand sanitizers. As a result, Agilent gained market share and boosted profitability in 2020. Agilent also upped its solar energy usage in 2020 by buying a company with its own solar farm.

and protect base pay, but they also used 3-D printers to make face shields for local healthcare providers and made masks and hand sanitizers. As a result, Agilent gained market share and boosted profitability in 2020. Agilent also upped its solar energy usage in 2020 by buying a company with its own solar farm.

The following story is about Nutrien, one of the leading agriculture companies in the world. Nutrien is reputable for its corporate governance policies and the transparency of financial information. Nutrien offers a comprehensive carbon program, providing end-to-end support for growers to improve sustainability performance and increase profitability. Through Nutrien’s precision agriculture technology, customers receive a full-acre solution with sustainable practices recommendations and a customized recipe of inputs to reduce nutrients lost, protect soils, and improve water and energy use. Nutrien also provides growers  with varieties of seed products that are drought and disease-resistant so that growers can use less water and pest control products. Growers receive further help from Nutrien on collecting carbon and other sustainability data reliably from the fields. At the end of the season, Nutrien and other carbon buyers verify the carbon outcomes and purchase the credit from growers. Through this integrated process year over year, Nutrien’s program rewards growers for adopting sustainable practices and establishing the agriculture industry as a leader in climate action.

with varieties of seed products that are drought and disease-resistant so that growers can use less water and pest control products. Growers receive further help from Nutrien on collecting carbon and other sustainability data reliably from the fields. At the end of the season, Nutrien and other carbon buyers verify the carbon outcomes and purchase the credit from growers. Through this integrated process year over year, Nutrien’s program rewards growers for adopting sustainable practices and establishing the agriculture industry as a leader in climate action.

Ecolab ranked third on Barron’s sustainability list, provides water treatment, cleaning, and sanitizing products and services to various industries. The company has helped customers save billions of gallons of water and associated heating costs and helped them create specific environmental impact goals. For example, it helped Microsoft reconfigure five data centers to be potable water and CO2 neutral. It is moving to use electric vehicles for its large automobile fleet. At the start of the pandemic, Ecolab ramped up capacity in disinfectant and sanitizer supply by up to 15 times, donated a million pounds of cleaning and sanitation products to the community, and funded out-of-work restaurant employees. Although one-third of its business, consisting of restaurants and lodging, was severely impacted, the company still protected its employees’ hourly pay.

The athletic footwear and apparel maker Nike has a goal of zero carbon emission and zero waste. A significant factor in reaching its goals is materials and the re-use of them, as they account for more than 70% of any product’s footprint. The company designed a lightweight precision fabric (Flyknit) with an average of 60% less waste than traditional footwear upper manufacturing and created a synthetic leather (Flyleather) by binding at least 50% recycled leather fibers with synthetic fibers using a water-powered process. Since 2008, all Nike Air soles are composed of a minimum of 50% recycled manufacturing waste. Its recycled polyester is made from plastic bottles, cleaned, shredded into flakes, converted into pellets, and then spun into yarn. Its recycled  nylon is transformed from a variety of materials such as carpet and used fishnets. The cotton used across its entire product line is certified organic or recycled from 2020, and currently, the company recycles more than 1.5 million pounds of cotton annually. All these incremental innovations and improvements culminate in Nike’s latest model, “Cosmic Unity” which is designed with at least 25% recycled material by weight.

nylon is transformed from a variety of materials such as carpet and used fishnets. The cotton used across its entire product line is certified organic or recycled from 2020, and currently, the company recycles more than 1.5 million pounds of cotton annually. All these incremental innovations and improvements culminate in Nike’s latest model, “Cosmic Unity” which is designed with at least 25% recycled material by weight.

Our last example is the utility company NextEra Energy, the largest renewable energy operator in the United States and based in the fourth-largest U.S. economy Florida. It develops and constructs projects in solar, wind, energy storage, and green hydrogen for its use or customers like other utility companies. The company’s management had the vision to enter renewable energies early and to gain a first-mover advantage. Despite the significant investments required for this transition, NextEra, through its regulated segment Florida Power & Light (FPL), offers competitive rates with residential customer bills about 30% below the national average.

As we learn more about the impact on the environment and society from human behavior, it is evident to us that we need to be conscious about where we invest. In the long run, less waste should lead to more profit for businesses. Productive growth should come with a diversified talent pool, and only ethical and well-governed companies will enjoy longevity. With information flow regarding ESG exploding recently, we need to be selective and objective when evaluating investment ideas using subjective data. That is why we insist on doing our research, listening to earnings calls every quarter, reading the company’s annual reports, and reviewing management track records. As we gradually obtain the knowledge and skill of evaluating companies based on sustainability, we also recognize that only financially sound businesses can support sustainable practices in the long run – this is an important point that we want to stress. Hence, while our screening funnel is wide open on the top to accept ESG ideas, fewer names will pass through the narrowed channel at the bottom because they must be both sustainable and fundamentally strong. This fine-tuned methodology is our answer to the ESG inquiry.

Sincerely yours,

Noesis Research Team