Inflation and Interest Rates

Dear Friend:

The topic of inflation and interest rates remained top of mind for investors throughout this year and last. We will discuss recent developments, their impact on fixed income and equity markets, as well as opportunities we have identified.

Inflation & Interest Rates

Since March 2022, the Federal Reserve (Fed) has raised its short-term interest rate, the federal funds rate, by 5.25% in response to elevated inflation. Initially misjudged as “transitory”, the Fed started an aggressive rate hiking cycle once it realized it was “behind the curve” with the growing risk of inflation becoming permanent. You might still recall the reasons during the pandemic: Strong demand by homebound consumers for all kinds of goods fueled by government stimulus payments. At the same time, there were disruptions and constraints in global supply chains due to temporary lockdowns. Remember the waiting time for a Peloton stationary bike or a printer for your new home office? Once economies reopened across the globe, consumer’s pent-up demand shifted from goods to services such as travel and entertainment. Airline fares increased and restaurants became crowded again despite raised menu prices.

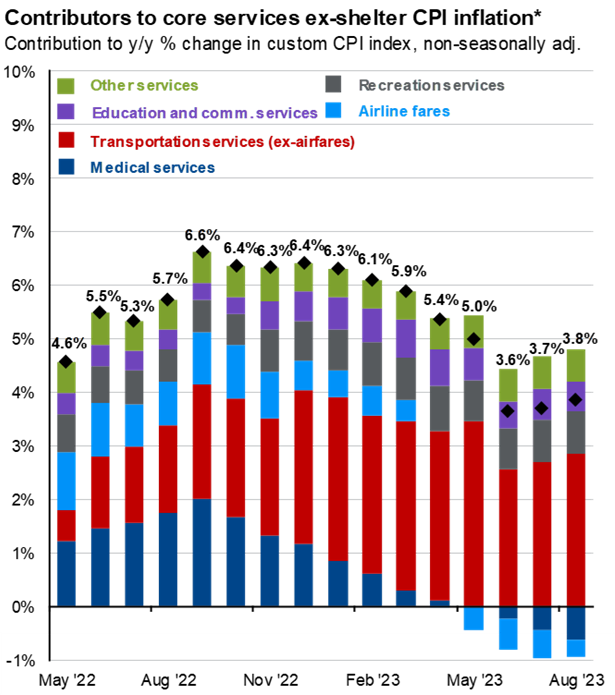

Inflation peaked during the summer of 2022. Since then, inflation of most components, in particular goods, has been trending downward. As can be seen in the first chart below, shelter, which measures the price increase of renting or owning a home, remains elevated and, with a weight of around 33%, is the main inflation driver. However, in the past few months, we have observed a trend change here as well. When excluding shelter from services, we see in the second chart below that inflation of transportation services also remains heightened, driven mainly by auto repair, insurance, and leasing. As prices of used cars are declining and of new cars increasing at a reduced rate, inflation of these related services might lessen over time.

Source: J.P. Morgan Asset Management

Despite these positive trends, the Fed does not want to declare victory and keeps a restrictive monetary stance. Core inflation, which excludes the volatile items of food and energy, still runs at approximately 4%, twice its target rate. In its latest update at the end of September, the Fed doubled its GDP growth forecast for this year as the U.S. economy is stronger than expected with healthy consumer spending, a solid labor market, nominal wage growth, and strong household balance sheets. At a recent industry conference, payment companies Visa, Mastercard, and PayPal also highlighted a resilient consumer spending environment. The Fed faces the dilemma of a too robust economy, which might require higher for longer interest rates.

Yields & Markets

Following the path of the federal funds rate, short-term yields increased immediately and have been offering attractive opportunities this year, such as U.S. treasury bills, short-term corporate bonds, or money market funds. Longer-term yields were range-bound for most of 2023 and only recently started to move higher (see chart below) as investors acknowledged the stronger economy and the resulting higher-for-longer rate bias by the Fed. Increased federal government borrowing and high deficits might be an additional reason for the upward pressure. Yields finally started to compensate for inflation again as real yields, after deducting inflation, became positive (see chart below). After investing and re-investing in short-term bonds for most of this year, we started to extend the duration in the past weeks and bought medium to long-term, high-quality bonds. We think it is wise to begin securing these elevated yield levels.

Source: Bloomberg Data

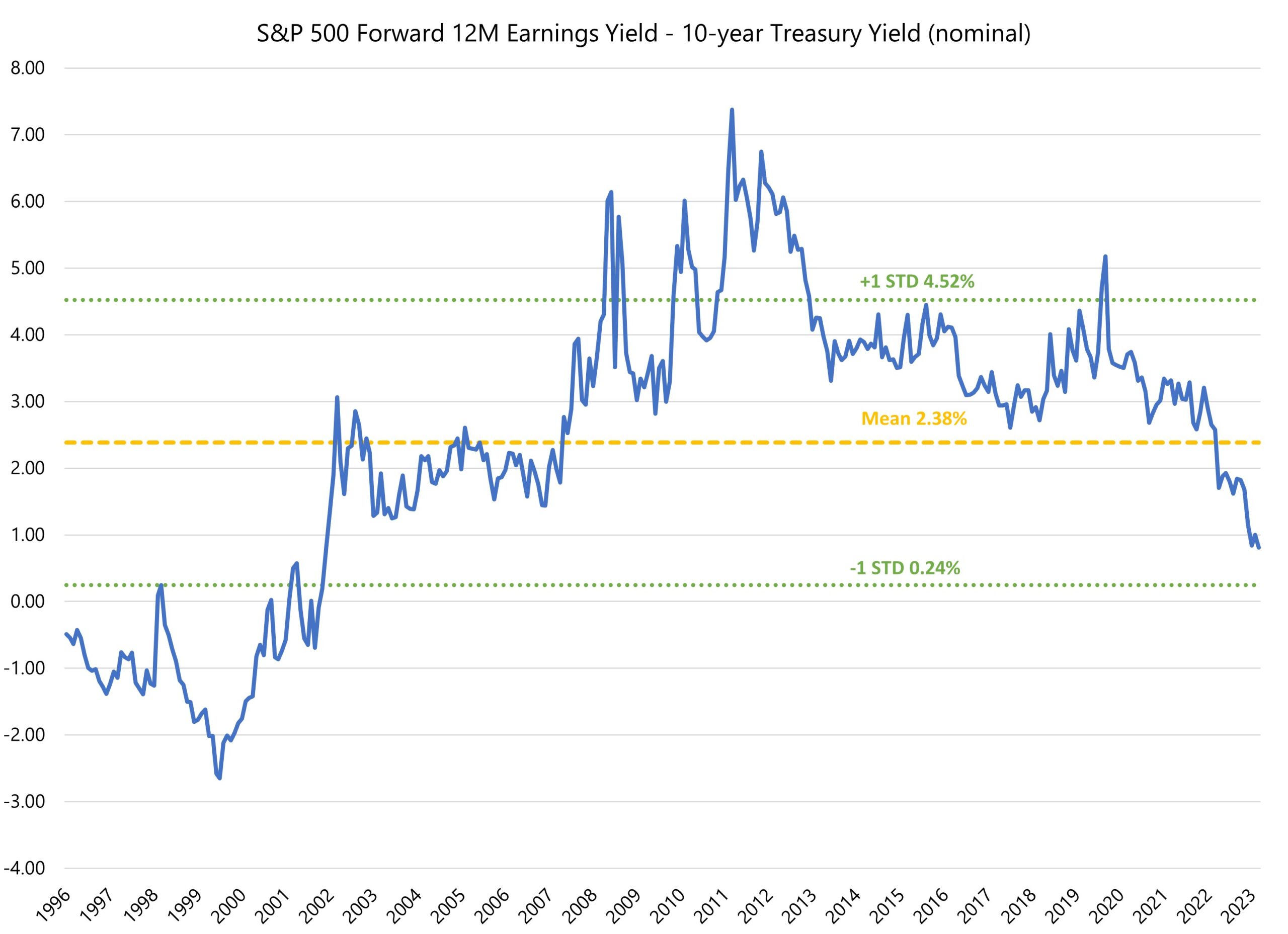

Fixed-income markets cannot be viewed in isolation as they have an impact on equity markets. Higher bond yields might attract more buyers, and they could finance their purchases by selling equities. Portfolio managers, including us, can take the opportunity to rebalance clients’ asset allocations and money flows from one to the other asset class. The relative attractiveness of equity versus bond markets can be estimated by the difference between the expected earnings yield of stocks and the treasury yield. As the chart below shows, the yield premium for equities is declining this year, and bonds are becoming an interesting competitor to stocks for the first time since the Great Financial Crisis. However, changing monetary policy accompanied by interest rate cuts can quickly reverse this equation and subsequent cross-asset money flows.

Source: Bloomberg Data

Conclusion

We believe that inflation has peaked and expect interest rates to decline, which should be beneficial for the stock market. However, timing peak yields is as difficult as timing the market. Therefore, we think it is opportune to lock in these high-interest rates. We will continue to search for opportunities across both markets, thereby considering your individual tax situation, income needs, and investment horizon.

Sincerely yours,

Research Team