Outlook for 2023

Dear Friend:

We had a cautiously optimistic outlook at the beginning of 2022 and did not expect it to be a challenging year like it had been. Several things surprised investors. First, inflation pressure continued to rise rapidly until the fourth quarter, so the central banks had to raise interest rates faster than anticipated. Second is the quickly evaporating confidence in the high-growth areas that were the pandemic’s primary beneficiaries. The third is how slowly East Asia reopened from the COVID lockdown, especially China, which was the leading cause for further supply chain issues and one reason inflation hasn’t been tamed. Finally, the Ukraine war eruption and the energy crisis in Europe.

We saw bubbles pop; for example, MEME stocks, which refer to company shares that gain a cult-like following through social media platforms, as well as the fallout of FTX, a bankrupt cryptocurrency exchange and crypto hedge fund. Warren Buffett famously described the situation the best: “Only when the tide goes out do you discover who’s been swimming naked.” Unfortunately, the same stories and the same behavior happened again and again. Investors should learn so many lessons from a year like 2022.

Lessons to be Learned

- Panic Selling – When the sentiment is low, the market is about to bottom. It is never a good strategy to sell when fear is at its highest. When investors’ confidence reaches a low point, the bounce back from the bottom is also quite rewarding. The S&P 500 index has returned 25% on average after 12 months for the past eight sentiment troughs. From the October 2022 low, it has recovered 7% by the end of 2022.

- Herding – When everyone is reading the same headline news and acting in the same way, sooner or later, good ideas get exploited, bubbles form, and they ultimately evaporate. The best examples are the MEME stocks fiasco in the past few years. When fundamentals are ignored, neighbors’ or roommates’ stock picks become trading ideas; failure is also implanted.

- Contrarian Approach – A picture says it all! The Sage of Omaha once said: “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.” The key is to find well-managed companies and invest while others are turning away.

One of our holdings, Taiwan Semiconductor (TSM), received much negative attention in the third quarter due to regional geopolitical tension. But contrarians like Warren Buffett saw that was a rare opportunity and acquired more than $4B in TSM’s stocks during the same quarter.

One of our holdings, Taiwan Semiconductor (TSM), received much negative attention in the third quarter due to regional geopolitical tension. But contrarians like Warren Buffett saw that was a rare opportunity and acquired more than $4B in TSM’s stocks during the same quarter.

Outlook for 2023

We believe there remain attractive opportunities in the cyclical sectors, including but not limited to consumer names, industrial companies, and financial services. First, U.S. consumers still have plenty of purchasing power due to the strong labor market, the wealth accumulation since the tax cut in 2018, and the appreciation of their assets. One trillion dollars of net excess savings remain compared to the pre-pandemic trend. The current U.S. household debt service ratio is below the decade’s average of 10% before the pandemic.

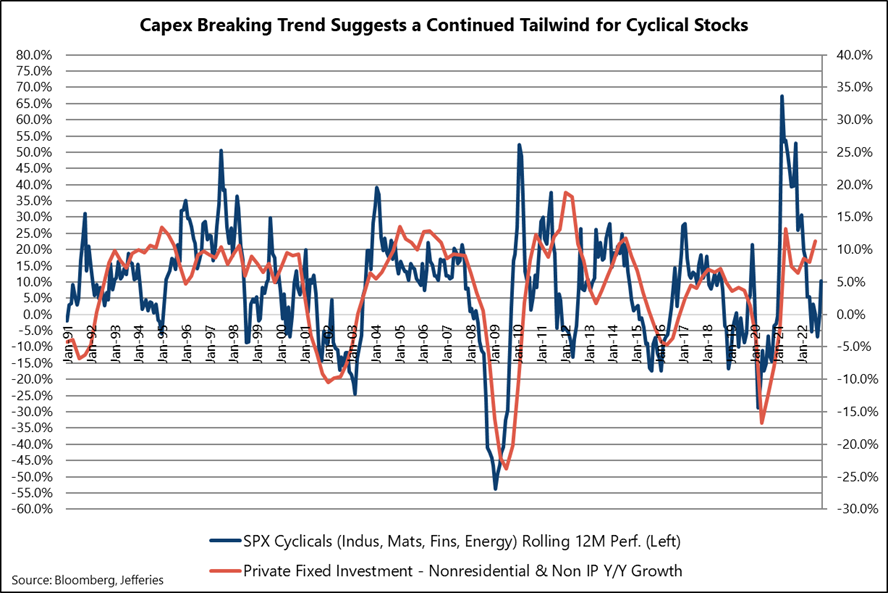

Second, with less inflation pressure, the demand will increase and the suppliers’ cost structure will gradually improve, which points to a better profitability outlook for the private sector. With the cautious positions most business leaders have held since the middle of 2022 and the renewed focus on cost efficiency, there is abundant capital for growth investment. The chart below shows a turnaround in capital expenditure (red line) in 2022. The cyclical sectors’ performance (blue line) was broadly in line with the fixed investment cycle which usually takes a few years to complete. Therefore, we believe there remains a tailwind in cyclical names. Furthermore, publicly traded companies can reward the shareholders by buying back shares while cash flow remains healthy. Either way will be good for the equity market.

The cyclical sectors’ performance (blue line) was broadly in line with the fixed investment cycle which usually takes a few years to complete. Therefore, we believe there remains a tailwind in cyclical names. Furthermore, publicly traded companies can reward the shareholders by buying back shares while cash flow remains healthy. Either way will be good for the equity market.

Some of these cyclical sectors performed poorly in 2022. For example, Consumer Discretionary has been the second worst sector after Communication Services. Consumers pull back spending items as they respond to inflation pressures and rising interest rates. However, according to FactSet Insight report as of Dec 15, 2022, Consumer Discretionary is the sector with the highest earnings growth expectations for 2023, 36% followed by the Industrial and Financial sectors at 14%, compared to 5% expected growth for S&P 500. Within the Consumer Discretionary sector, there have been mixed results. Some saw healthy growth supported by strong consumer balance sheets and low unemployment rates, while others felt the pinch as demand shifted among categories.

Industrials is another sector that tends to go up as the economy expands and vice versa. One of the key traits of a strong industrial company is its diversified end markets. Such a company can capture growth from end markets with secular growth like electrification, energy transition, and digitalization that can offset the swing in profits from cyclical industries that vary with consumer spending, for instance, electronic devices companies. We believe there are long-term winners that have been beaten down unfairly along with other cyclical names in 2022.

One specific area we like is Information Technology.  Information infrastructure is the next electricity grid of our lives, and digital data is the new electricity to support our daily activities. It is hard to imagine a world with less internet usage or fewer mobile devices. The correction in the IT sector in 2022 was a rebalancing of extreme demand from the pandemic level back to a normalized pace. That was just a detour in a long-term secular trend. However, the correction does provide chances to buy great IT companies at lower prices. The next group on our watch list is the laggers of the COVID recovery. This group includes regions that were slow to open from the lockdown and industries impacted by the shortage of labor and supplies.

Information infrastructure is the next electricity grid of our lives, and digital data is the new electricity to support our daily activities. It is hard to imagine a world with less internet usage or fewer mobile devices. The correction in the IT sector in 2022 was a rebalancing of extreme demand from the pandemic level back to a normalized pace. That was just a detour in a long-term secular trend. However, the correction does provide chances to buy great IT companies at lower prices. The next group on our watch list is the laggers of the COVID recovery. This group includes regions that were slow to open from the lockdown and industries impacted by the shortage of labor and supplies.

Lastly, from a valuation point of view, we should pay more attention to non-U.S. opportunities. The chart on the right shows that international equities are traded twice the average discounts (-28.0% versus -14.2%) of the S&P 500 index at the end of the fourth quarter.

Fixed Income

2022 was the year where perceived “transitory” inflation was at risk to become permanent with inflation accelerating to multidecade highs in many regions globally. In response, central banks delivered one of the fastest and most synchronized rate hike cycles on record during which the Federal Reserve (Fed) delivered 4.25% of rate increase since March, the European Central Bank (ECB) 2.5% since July, and central banks globally around 3.0%. This tightening monetary policy led to large price declines across fixed income securities; in the U.S. the broad-based bond market had a total return, which includes coupon payments, of -13% in 2022. The path of inflation, in particular wage growth, will determine when the Fed and other central banks will not only pause, but whether they will start to cut rates.

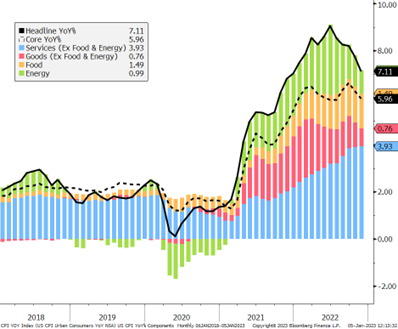

On the one hand,  the Fed signals a tough stance and sees upside risk to inflation mainly due to the still very strong labor market with an imbalance between supply and demand of workers. It is concerned about a scenario where high prices become entrenched in the economy like in the 1970s during which the U.S. experienced three waves of inflation spikes. On the other hand, prices are already slowing for goods (see chart for red bars) and for energy (green bars). While service inflation (blue bars) remains elevated, the large component housing/rent might start to decline this year and bring further relief.

the Fed signals a tough stance and sees upside risk to inflation mainly due to the still very strong labor market with an imbalance between supply and demand of workers. It is concerned about a scenario where high prices become entrenched in the economy like in the 1970s during which the U.S. experienced three waves of inflation spikes. On the other hand, prices are already slowing for goods (see chart for red bars) and for energy (green bars). While service inflation (blue bars) remains elevated, the large component housing/rent might start to decline this year and bring further relief.

In previous years we were concerned about the risk of rising interest rates and resulting falling bond prices. Consequently, we underweighted the fixed income allocation in our client portfolios. Continuously rising yields in 2022 made this asset class attractive again and we started to buy high quality bonds predominantly with short-term and intermediate-term maturities. We will continue to increase the allocation to fixed income securities and look for opportunities across different maturities.

We appreciate that you stayed invested and worked with us during a challenging year. Many of you refer family members and friends to us because you have recognized that we are partners in this journey. We wish you a healthy and happy new year!

Sincerely yours,

Research Team