The Challenge and Opportunity of Inflation

Dear Friend:

It has been a year since we discussed the supply chain issue, labor shortage, ongoing pandemic, China slowdown, and inflation. Some of the challenges persist and continue to cause colossal volatility in the stock markets. The recent focus has been on inflation and the central banks’ actions to tame it. Inflation was driven by higher demand than supply, so it is a problem of two sides. Changed consumer behavior during the pandemic and aggressive expansionary monetary policies created strong demand, whereas the ongoing pandemic and Ukraine War caused issues on the supply side.

Investors might question why inflation did not occur after the Financial Crisis in 2008 since aggressive monetary policies were used both times. However, stimulus money was injected into the economy at a much larger scale during the pandemic, which is shown in the chart to the right. Money supply, measured as M2 and consisting of currency notes, bank deposits, and money market funds, grew more than 25% during 2020 compared to 10% in 2008. We believe that the repeated sending of stimulus checks to consumers and the forgiven loans to small businesses immediately impacted behavior this time. The sudden increase in available funds and the limited outside activities caused a purchase impulse across all goods. We don’t believe the aggregate

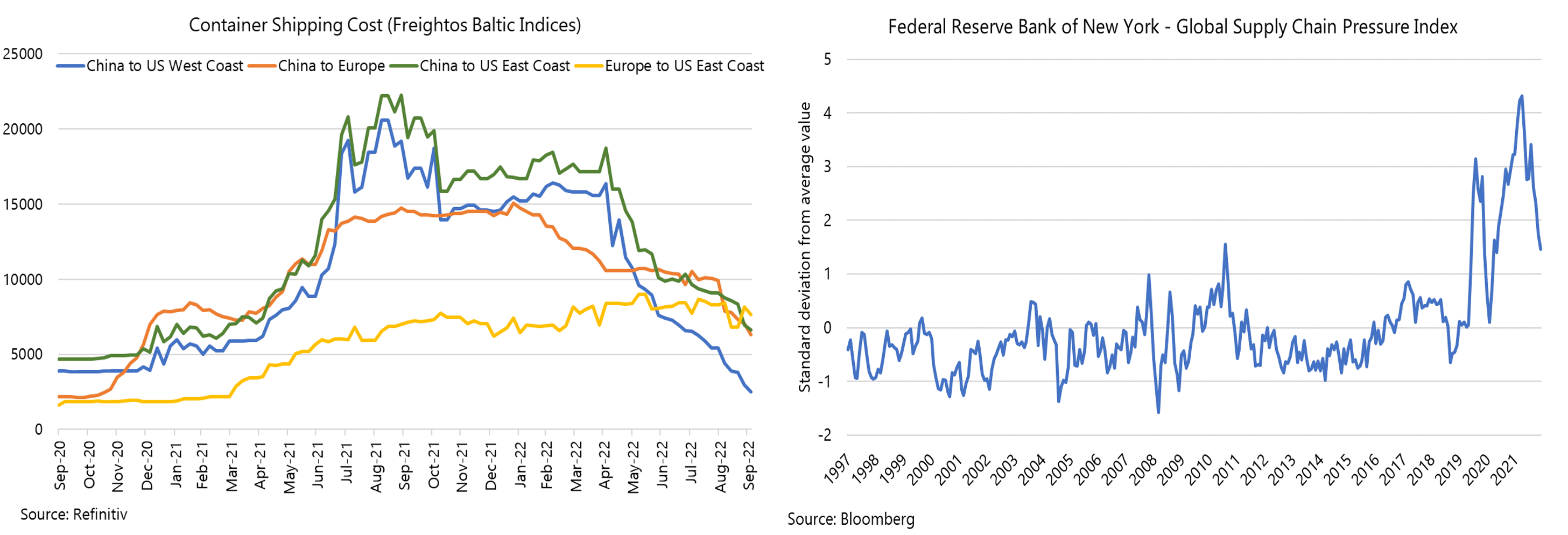

Investors might question why inflation did not occur after the Financial Crisis in 2008 since aggressive monetary policies were used both times. However, stimulus money was injected into the economy at a much larger scale during the pandemic, which is shown in the chart to the right. Money supply, measured as M2 and consisting of currency notes, bank deposits, and money market funds, grew more than 25% during 2020 compared to 10% in 2008. We believe that the repeated sending of stimulus checks to consumers and the forgiven loans to small businesses immediately impacted behavior this time. The sudden increase in available funds and the limited outside activities caused a purchase impulse across all goods. We don’t believe the aggregate  demand will fall off the cliff with a strong U.S. labor market, increased household wealth, and a renewed appetite for “service” consumption (see left chart for inflation components). However, there are pockets of weak demand; for example, new and used vehicles and personal computers. We also see improvement on the supply side: lower container shipping cost and airfreight cost, reduced delivery times and order backlogs, and availability of semiconductor chips in some end-markets (see chart for container shipping cost). The Federal Reserve (Fed) aggregates these various components of the global supply chain in a single index, which indicates rapid improvement from the constrained situation in 2020 and 2021 (see chart for global supply chain pressure index).

demand will fall off the cliff with a strong U.S. labor market, increased household wealth, and a renewed appetite for “service” consumption (see left chart for inflation components). However, there are pockets of weak demand; for example, new and used vehicles and personal computers. We also see improvement on the supply side: lower container shipping cost and airfreight cost, reduced delivery times and order backlogs, and availability of semiconductor chips in some end-markets (see chart for container shipping cost). The Federal Reserve (Fed) aggregates these various components of the global supply chain in a single index, which indicates rapid improvement from the constrained situation in 2020 and 2021 (see chart for global supply chain pressure index).

At Noesis, we want to own companies that can weather harsh environments and take market share during challenging periods. Last year, we highlighted companies that were strong at fighting supply chain issues and efficient in their operations. This year, we want to share stories of companies that are successfully coping with inflation and delivering sustainable growth.

PepsiCo is one of the companies that has navigated the high inflation environment. The company managed to increase prices without hampering volume. In the quarter ending in June this year, volume increased by 1% despite a high 12% price increase in its product portfolio. The price increase was below its product cost inflation because PepsiCo was able to cut internal costs and rely on digital investments to manage inventory more precisely at individual stores. Pepsi may continue to raise prices after seeing limited pushback from consumers.

The company believes the reason for the resilient performance is twofold: their products represent an ‘affordable treat’ and their commercial programs continue to attract consumers because of innovation, execution,  and strong brand awareness. Its portfolio expands beyond just soft drinks to a wide variety of non-carbonated beverages as well as snacks, which represent 55% of company revenue, and management was early to offer healthier, sugar-reduced, and more nutritious options. The food and snack giant has solidified its position as an inflation hedge and a top-class defensive stock as it showcased its immense moat and pricing power. Pepsi has outperformed the market year-to-date (see chart on the right).

and strong brand awareness. Its portfolio expands beyond just soft drinks to a wide variety of non-carbonated beverages as well as snacks, which represent 55% of company revenue, and management was early to offer healthier, sugar-reduced, and more nutritious options. The food and snack giant has solidified its position as an inflation hedge and a top-class defensive stock as it showcased its immense moat and pricing power. Pepsi has outperformed the market year-to-date (see chart on the right).

Another category that has shown resiliency during the high inflation period is the cosmetics industry. We participated through our investment in L’Oréal in June this year. According to the executives of the company, “beauty is always growing”. Historically, there has only been one year when the market slowed down: It was in 2020 when the stores were closed during the pandemic and not because people did not want to buy beauty products.

Like any industry, the company did feel the impact of inflation due to cost pressure. Shifting shoppers to pricier, premium brands is helping L’Oréal weather its own cost inflation. The company said innovation is also helping it absorb higher costs while still investing in its brands. Despite inflation, L’Oréal’s operating profit margin expanded by 0.7% in the first half of the year compared to the previous year. L’Oréal sells a wide variety of mass-market and luxury products that cover a wide spectrum of income classes, and inflation has more impact on their mass market than on their luxury market. The Consumer Products division (mass market) and Luxury division each represent about 37% of sales, while Professional Products and Active Cosmetics together account for the remaining 26%. The company has not seen a slowdown or trade down in cosmetics sales so far, but if this was to happen, it has mass market products that can cater to consumers who may need more affordable options.

In fact, the company brought up the ‘lipstick index’ which says that when times are tough, women tend to spend more on indulgence goods that make them feel better. Through innovation, the company creates products that give consumers affordable pleasures.

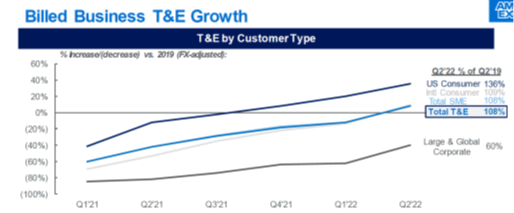

Global payment companies American Express and Visa have good insights into the state of the consumer. American Express reported for its second quarter a continued recovery of its travel and entertainment spending volume (so-called ‘billed business’) that was above the pre-pandemic level of 2019 (see chart for billed business T&E growth). The U.S. consumer segment particularly showed strength, reaching 36% above the 2019 level. In addition, the credit quality of American Express cardholders remains strong with low payment delinquencies and charge-offs. Management commented that it exceeded its expectations from the beginning of the year.

Visa’s management emphasized in its last earnings call a general shift in spending toward services and experiences like travel, dining, and entertainment, and away from goods. The buyer remains resilient as affluent consumer spending is rising, particularly in the before mentioned service categories, while spending of non-affluent consumers remains stable. Travel-related cross-border payment volume rose to 116% of the 2019 level (see chart for cross-border volume) despite suppressed in-bound travel to Asia, especially to China and Japan, from ongoing travel restrictions.

While Visa’s payment data cannot show if consumers are trading  down from brand name to private label products, or substituting discretionary with staple items, they, together with American Express’ data, point to a healthy consumer withstanding the inflation headwinds.

down from brand name to private label products, or substituting discretionary with staple items, they, together with American Express’ data, point to a healthy consumer withstanding the inflation headwinds.

The challenge and opportunity of inflation can be also witnessed in the fixed income market. The rise in interest rates driven by the Federal Reserve’s tightening monetary policy led to large price declines across fixed income securities. The broad-based U.S. bond market had a total return, which includes coupon payments, of -15% year-to-date (through September 30), while U.S. corporate bonds returned -19%, and perceived “safe” U.S. treasuries returned -13% for the same period. We were concerned about the risk of rising rates and therefore underweighted the fixed income allocation in our client portfolios. However, continuously rising yields make this asset class attractive again and we recently started to buy high quality bonds predominantly with short-term and intermediate-term maturities.

It is impossible to correctly predict the top of this interest rate cycle. The derivative market currently prices the peak in the Fed funds rate for March 2023 and in the ECB short-term rate for June 2023. However, the persistency of inflation, resiliency of the U.S. economy in particular of its labor market, and the rate differential to other currencies are all factors impacting the future direction of bond yields. Not to forget the rhetoric of the Fed’s central bankers who just recently reiterated their tough stance on inflation, signaling a “higher-for-longer” interest rate environment to investors. We will continue to look for opportunities across the maturity spectrum and will increase the allocation to fixed income securities over time.

Challenges from inflation do exist: Low-income households are hurt by higher food and energy bills as well as rising rent payments, and wage increases might not fully compensate for these additional outlays. On the other hand, investors usually own their homes, which have increased in value in recent years, while food and energy expenses stand in smaller relation to their income. In addition, they have the opportunity to invest in quality companies at reduced valuations and in bonds which offer a moderate yield again.

Thank you for your continuous trust in us. We welcome your questions and please let us know if there is something more that we can do for you, your friends, or colleagues. We appreciate you keeping us in mind, as referrals are an important part of our business.

Sincerely yours,

Research Team